federal unemployment tax refund tracker

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

System to follow the status of your refund.

. In late May the IRS started. Contributions to a state unemployment. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed.

If youre anticipating an unemployment tax refund your best bet is to track the status of it and see. Use our Wheres My Refund. Check For The Latest Updates And Resources Throughout The Tax Season.

To check the status of your personal income tax refund youll need the following information. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by.

After this you should select the 2020 Account Transcript. Unemployment Refund Tracker Unemployment Insurance TaxUni. Generally you can deduct premiums you pay for the kinds of insurance used in your business.

With the latest batch of payments the IRS has now issued more than 87 million unemployment compensation refunds totaling over 10 billion. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Tax year of the refund Your Social Security number SSN or Individual Taxpayer.

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Can I deduct unemployment insurance. We only deposit up to five Minnesota income tax refunds and five property tax refunds into a.

Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My.

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

10 200 Unemployment Refund Check Status How To Check Your Unemployment Refund With The Irs Youtube

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

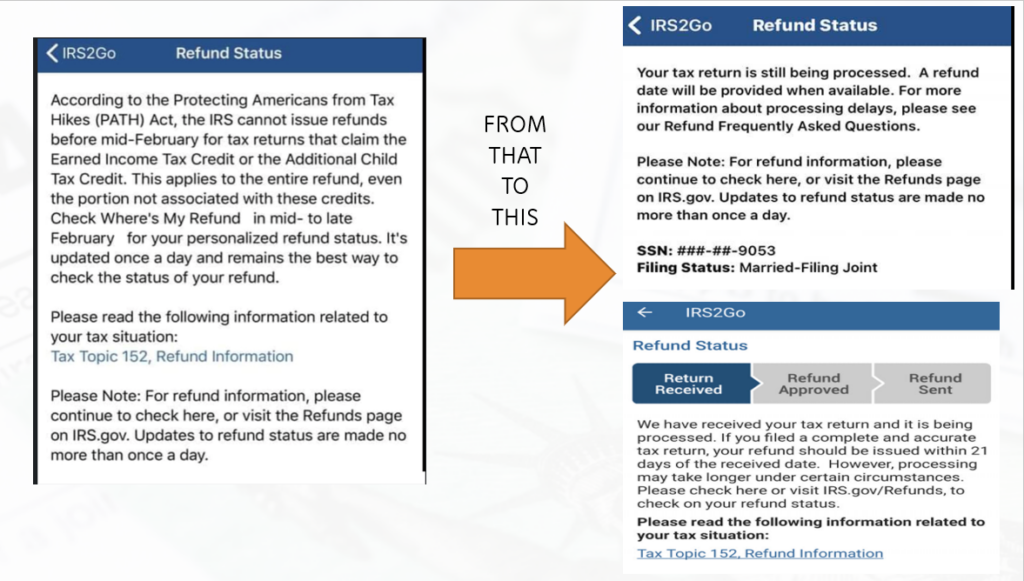

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

![]()

Tax Refund Tracker Where S My Refund Tax News Information

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

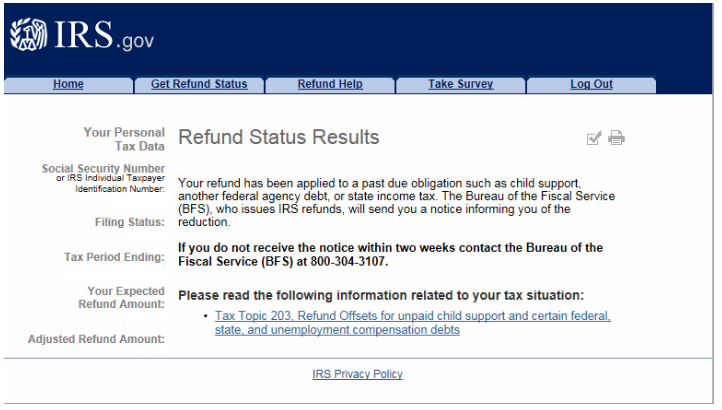

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa